Amidst ongoing fiscal pitfalls in some of the major economies of the world, real estate in emerging markets are becoming promising assets for global investors. Over the years, institutional investors are earmarking larger funds for real estate in these emerging markets in search of either steeper price growth or sustainable appreciation in the mid or longer run.

Apart from regular favorites such as India, UAE, Central and Eastern Europe (CEE) and China, investors are also willing to go up the risk curve and bet on new territories that were nearly unheard of a decade back. For example, many emerging hotbeds in Africa have witnessed aggressive placements in the recent times despite proliferating political risks and slowdown in commodity exports. In its third installment, Actis Africa, a London-headquartered fund has deployed around USD 500 million to be invested across office, logistic and retail projects. Likewise, RMB Westport (South Africa based) development has invested around USD 250 million in developing world class retail and office projects in Nigeria, Ghana and Angola. There are numerous other internationally backed funds such as Momentum Global from UK which are making aggressive investments in African real estate. In addition to elevated yield potential, subdued property prices and depreciating currency is further priming investor interest in African realty markets.

Secured Investment Alternative

Post the sub-prime crisis, emerging markets have emerged as safe and sound investment bet for many global investors. Real estate demand in such markets has been a beneficiary of decent economic growth, surge in population, spurred urbanization and expansive middle class with higher disposable income. Many emerging markets around the world have also taken prudent steps to bring in wider policy reforms and increased transparency thereby further drawing the attention of global fraternity. For instance, in UAE, steps such as increasing the registration fee have been taken to curb speculation. Likewise, RERA has been implemented in India to prevent malpractices in real estate transactions and safeguard interests of buyers. In China, the official clampdown on illegal financing for developers continues to mitigate any potential property bubble.

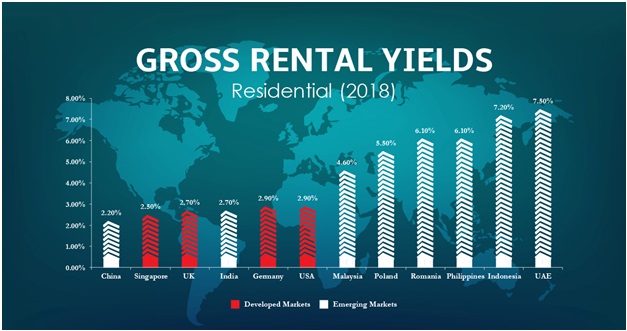

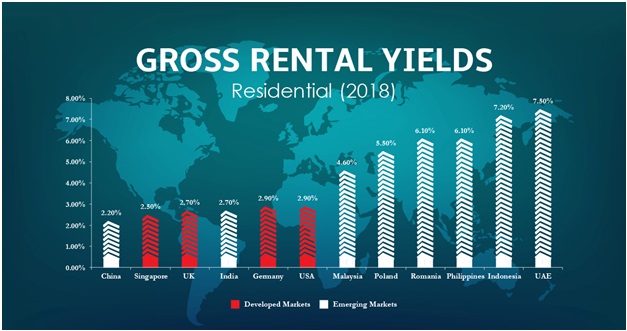

Emerging markets are also attractive due to higher rental yields when compared to some of the developed markets in the world. Rising economies such as Poland, Romania, UAE and Indonesia offer much higher rental yields than USA, Singapore and UK. In an illiquid asset such as real estate, rental yields matter a lot.

Positivity will Continue

On the back of high demand and benign growth numbers, real estate in emerging markets will continue to channelize a sizable part of the global capital flow in the times ahead. However, the trends will not underpin any common narratives. Rather, it will be multilayered and revolve around numerous themes simultaneously.

Institutional money will continue to flow into popular destinations such as India, China and CEE. Indian real estate has attracted over USD 10 billion of institutional money in 2018. Similar uptrends will continue going forward. In China, along with Tier 1 cities, investors will also leverage growth potential in Tier 2 cities. Upcoming sectors such as logistics and retail will enjoy greater investor deal inflows in the times ahead in the CEE region. Its proximity to the developed markets of Europe and cultural resemblance will further prime investment inflow.

In Asia other upcoming markets such as Vietnam, Malaysia and Indonesia will see notable growth by the investor fraternity. On the back of an upbeat economy, Vietnamese cities such as HCM and Hanoi enjoy one of the highest office rental yields across the world. This will surely result in some big ticket size placements in the near future.

Down cycles might continue for some more time in major international emerging markets such as Brazil and Russia thereby softening deal inflows in the immediate future. After showing some signs of expansion in the first half of 2018, growth numbers tapered in the Middle East and North Africa (MENA) region due to a sharp decline in oil prices. Apart from weakening economic growth, investments in the region will be further marred by political uncertainties as many investors might not be willing to ride the risk curve.